taxual healing - time for tobin?

Bush is going all socialist by providing around $1tn to bail out three financial institutions, or else the economy will go bust. Wall Street are loving this nationalisation, it's all they've got left. The traders are already thinking about how they can capitalise on this mess and the CEOs have already got their fat bonuses secured whatever happens. In the end, everyone's a winner right?

Well in the real world, the "have nots" have just realised that we've been taking over the responsibility of the risks of the "have yachts". Why can Bush and Wall Street implement measures that we were ridiculed for proposing them before it got any worse?

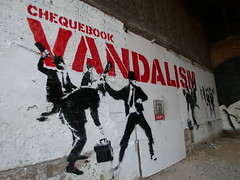

When we warned that the financial sectors' ability to avoid taxation probably affects social cohesion more than a teenager spraying graffiti on your wall? Would we have been more credible if it had been the "too big to fail" City saying this rather than the social democratic left?

But let's move beyond the "we told you so" (we did..he did even earlier) and the "I believed this all along" (but didn't act on it?) and look at proposals to get us out of this mess. Don't look at me, I'm no economist, but my friend Henning Meyer's proposition merits attention.

But let's move beyond the "we told you so" (we did..he did even earlier) and the "I believed this all along" (but didn't act on it?) and look at proposals to get us out of this mess. Don't look at me, I'm no economist, but my friend Henning Meyer's proposition merits attention."If the taxpayer's money is used to secure the risks financial industries produced, financial institutions should vice versa contribute more than previously to the provision of public goods and welfare systems, which are there to insure individual citizens against life risks."

OK but how do we this in practice given how complex and different tax structures are in each country? Henning proposes the introduction of a transaction tax, like for example the Tobin Tax.

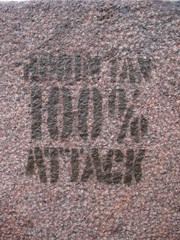

What's the Tobin Tax? It taxes currency conversions in foreign exchange markets which reduces the incentives to speculate in the short term. How does this add up? Henning works out that given the turnover in these markets is around $3.2tn, even if you went for a very cautious 0.05% tax, you would create a revenue of at least $400bn a year. But won't the financial sector complain about this new tax? Are they complaining about the money the taxpayer is bailing them out with?

What do we do with that money? We could start by using it to help insure our residents from life risks. And then we could making the system more transparent. We could stop the "double shuffle" strategy of humanising the market with one hand and deregulating it with the other. "Whatever it takes".

Now that doesn't sound too radical does it?

PS. Just don't tell the "coalition within the party" that the alterglobalisation movement Attac was founded to campaign on the Tobin tax...

0 comments:

Post a Comment